Bitcoin miner Iren has faced a challenging year, but JPMorgan analyst Reginald Smith sees an opportunity to buy low. Smith upgraded Iren to overweight from neutral, expressing confidence in the company's potential for growth. Despite lowering the price target to $12 from $15, Smith's new forecast indicates a promising 70% upside. The stock has experienced a significant 28.3% decline in 2025, reflecting the struggles of the broader crypto market amidst policy uncertainties.

Price Target Adjusted to $12

Smith has revised the price target for Iren to $12, down from $15, but still anticipates a 70% increase in value moving forward. Smith praises Iren's efficiency and renewable energy use, sparking a 2% stock increase. Analysts bullish on Iren with 221% potential upside.

Market Challenges in 2025

Throughout 2025, Iren has faced a significant drop of 28.3% in its stock value, reflecting the overall struggles in the bitcoin and cryptocurrency market due to policy uncertainties from the Trump administration.

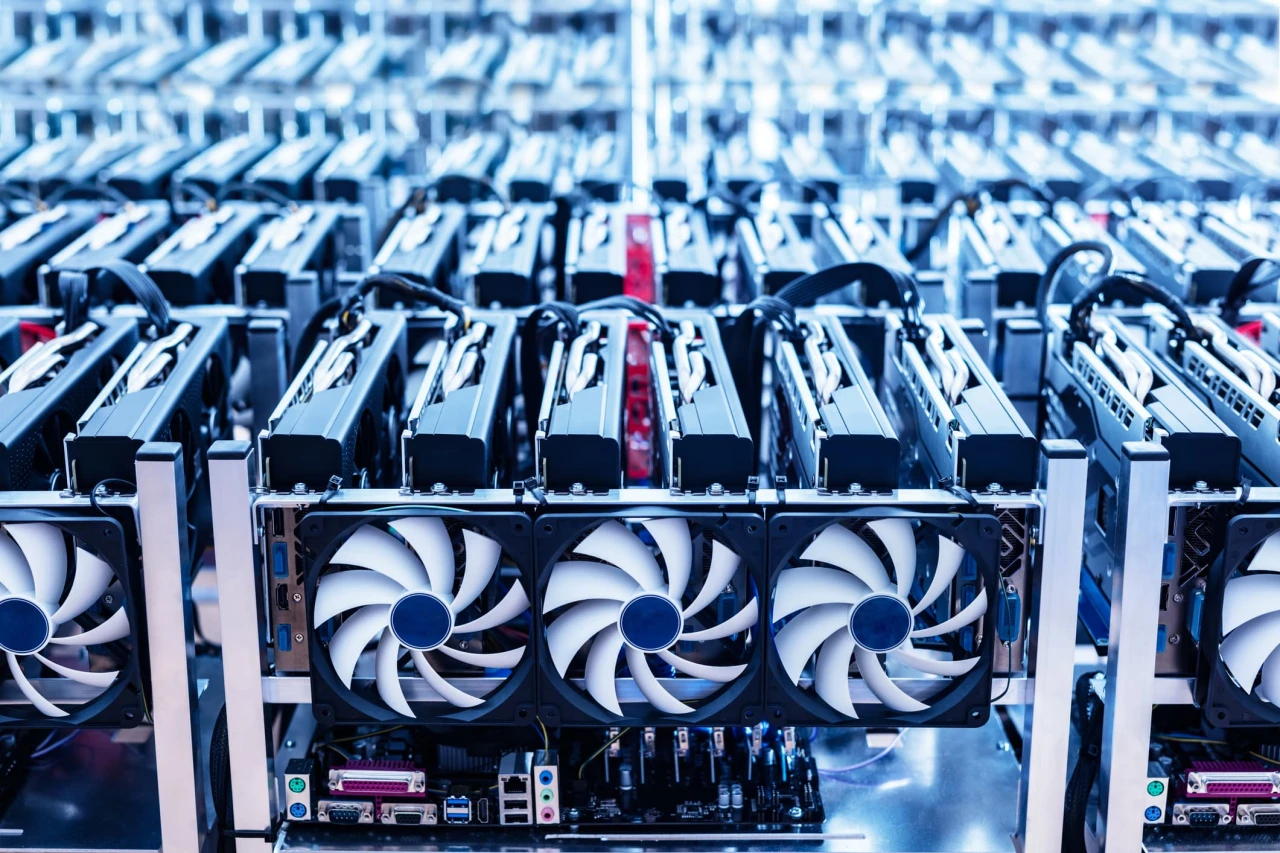

Iren, known for being the lowest-cost publicly traded bitcoin miner, operates data centers and electrical infrastructure primarily powered by renewable energy. Smith emphasized the company's efficiency and strategic positioning in the bitcoin mining sector. The recent upgrade by JPMorgan has sparked a positive market response, with shares rising by 2% following the announcement.

Positive Outlook on Iren's Future

Despite the setbacks, Smith remains optimistic about Iren's position as a cost-efficient bitcoin miner, emphasizing the company's renewable energy-powered data centers and high power computing capabilities.

Although Iren is not widely covered by analysts, the majority who follow the stock hold a bullish outlook. According to LSEG data, 10 out of 12 analysts recommend buying Iren, with an average price target suggesting a remarkable 221% potential upside. Smith believes that the current valuation presents an attractive entry point for investors seeking exposure to a leading bitcoin mining operator with high power computing capabilities.

Analyst Recommendation and Market Response

Smith rates Iren shares as Overweight, highlighting the current undervaluation as an attractive opportunity for investors. Following the upgrade, the stock saw a 2% increase before the market opening. JPMorgan analyst Reginald Smith has raised his rating on Iren, a bitcoin miner, from neutral to overweight despite a challenging year for the company.

Positive Analyst Consensus

Although Iren isn't widely covered, data from LSEG reveals that 10 out of 12 analysts recommend buying or strongly buying the stock. The average price target suggests a substantial 221% potential upside.