The projected rise in share prices indicates a bullish sentiment in the market and could attract more interest from traders looking to capitalize on the expected uptrend. Investors will likely keep a close eye on this development and adjust their investment strategies accordingly to benefit from the anticipated increase in stock value.

Goldman Sachs has expressed optimism about the rapid expansion of autonomous driving company Pony AI. Analyst Allen Chang has reaffirmed a buy rating on the stock, increasing the 12-month price target to $22.50, up from $19.60. This adjustment suggests a potential 22% increase in share value compared to the previous day's closing price.

Pony AI's Expansion Strategy

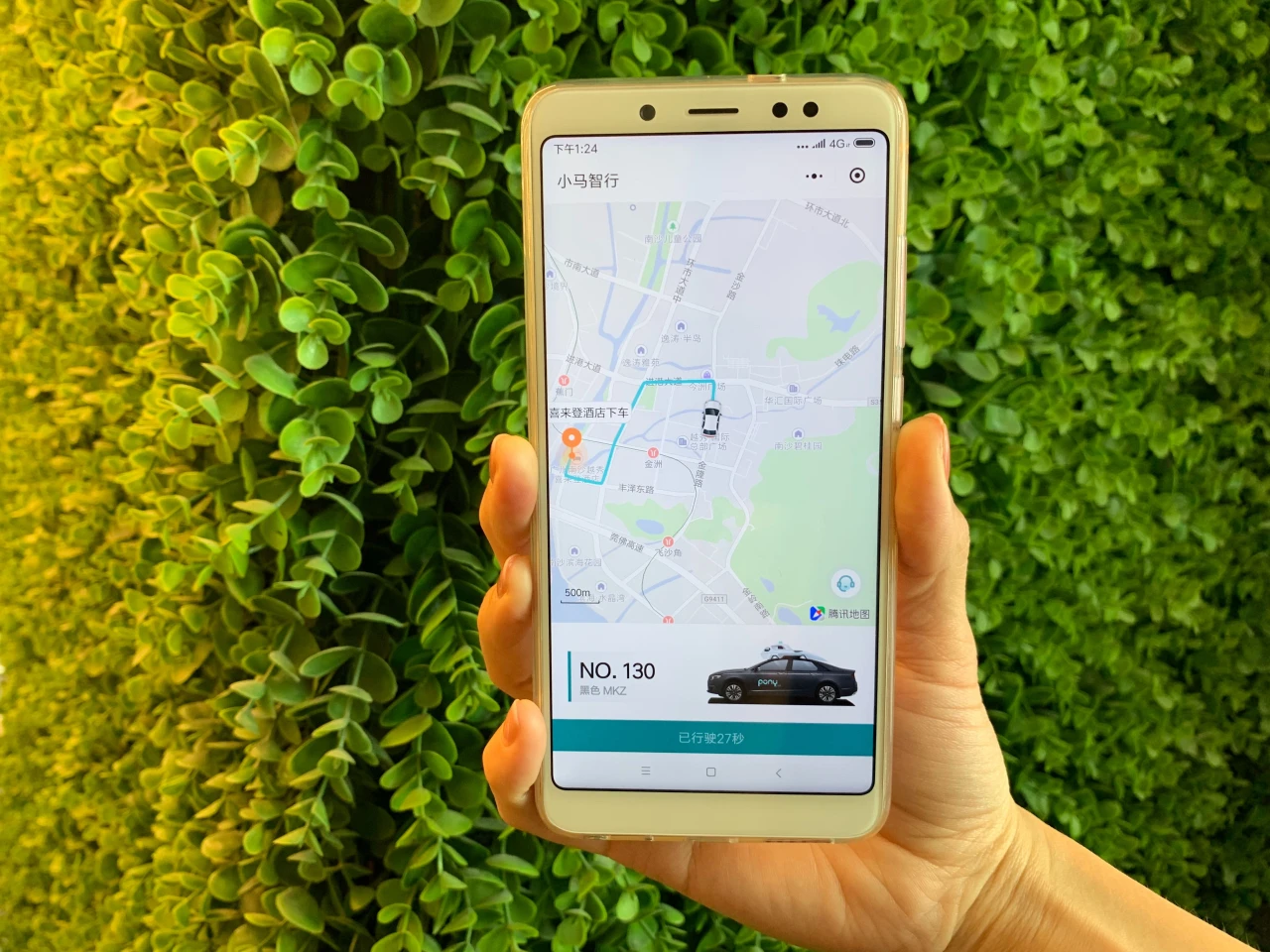

Based in Guangzhou, China, Pony AI has been aggressively expanding its robotaxi operations, as noted by Chang. The company recently obtained a qualification recognition in the Greater Bay Area of China, which paves the way for acquiring other qualifications necessary for cross-city operations.

Advancements in Autonomous Driving

In a significant development, Pony AI initiated driverless tests on a Beijing highway last month and announced the commencement of services at the Hong Kong International Airport. Chang emphasized the company's strengths in research and development, early market entry for Robotaxi licenses in key cities, and its strategic ecosystem and partnerships that aim to reduce operational costs and enhance customer acquisition.

Market Performance and IPO

According to FactSet data, Pony AI's American Depositary Receipts on Nasdaq showed a 22% increase in 2025 following a 17% decline in 2024. The company went public in late November 2024 through an initial public offering managed by Goldman Sachs.

Future Outlook

PONY 1D mountain Pony AI's shares rose on Thursday, reflecting positive market sentiment towards the company's growth prospects. The collaboration between Pony AI and Goldman Sachs underscores a promising trajectory for the autonomous driving industry.