While 56 analysts rate Nvidia as a buy or a strong buy, this lone investment bank holds a different view. This divergence in opinions showcases the varying perspectives within the financial industry when it comes to evaluating the prospects of companies like Nvidia. It highlights the complexity and subjectivity involved in analyzing and predicting the performance of tech stocks in today's dynamic market environment.

Ahead of Nvidia's highly anticipated quarterly earnings release next Wednesday, Deutsche Bank is one of the few Wall Street banks that is refraining from recommending the chipmaker.

Quarterly Earnings Report on the Horizon

Nvidia is set to announce its results for the fiscal fourth quarter that concluded in January after the market closes on Feb. 26.

Challenges and Growth for Nvidia

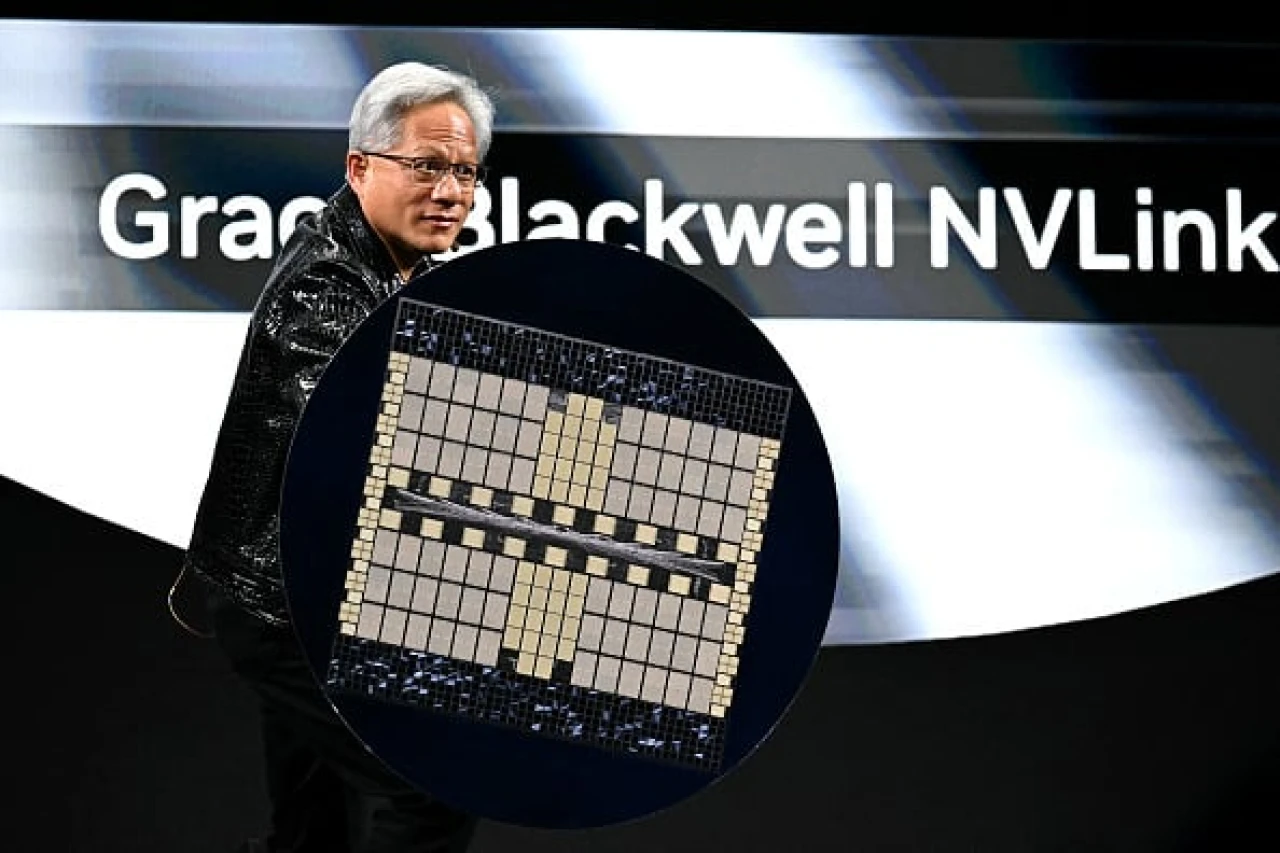

Jensen Huang's company has faced a slow start to 2025, with shares experiencing only a 4.3% increase following a January sell-off triggered by the emergence of China's DeepSeek artificial intelligence platform.

Contrasting Views on Nvidia's Future

Despite the recent challenges, Nvidia's stock has more than doubled in the last 12 months and continues to be a prominent name in the AI sector.

Deutsche Bank's Cautionary Stance

Deutsche Bank has restated its hold rating on Nvidia, diverging from the majority of Wall Street analysts who overwhelmingly recommend buying the stock.

Deutsche Bank's Price Target vs. Market Consensus

While most analysts project a price target of $172 for Nvidia, Deutsche Bank remains conservative with a target of $140 per share, close to the stock's recent closing price.

Analysis of Nvidia's Future Performance

Analyst Ross Seymore foresees positive results for Nvidia but anticipates that the company's guidance for the upcoming quarter may only align with market expectations, limiting potential stock growth.

Concerns about Long-Term Demand

Seymore highlights concerns about sustaining the high demand for Nvidia processors in 2026 and beyond, which could pose a challenge to the stock's upward trend.

Conclusion

As investors await Nvidia's earnings report, the company's performance and future outlook remain subjects of scrutiny, with differing opinions prevailing among analysts regarding its growth trajectory in the AI market.