This decision marks a calculated investment approach by Niles, indicating potential opportunities for growth and value in the technology sector. Niles' plan to purchase these underperforming stocks suggests a contrarian investment strategy, which aims to capitalize on potential market rebounds and undervalued assets. As a seasoned investor, Niles' move highlights his confidence in the long-term prospects of these technology stocks and his ability to identify investment opportunities amidst market fluctuations.

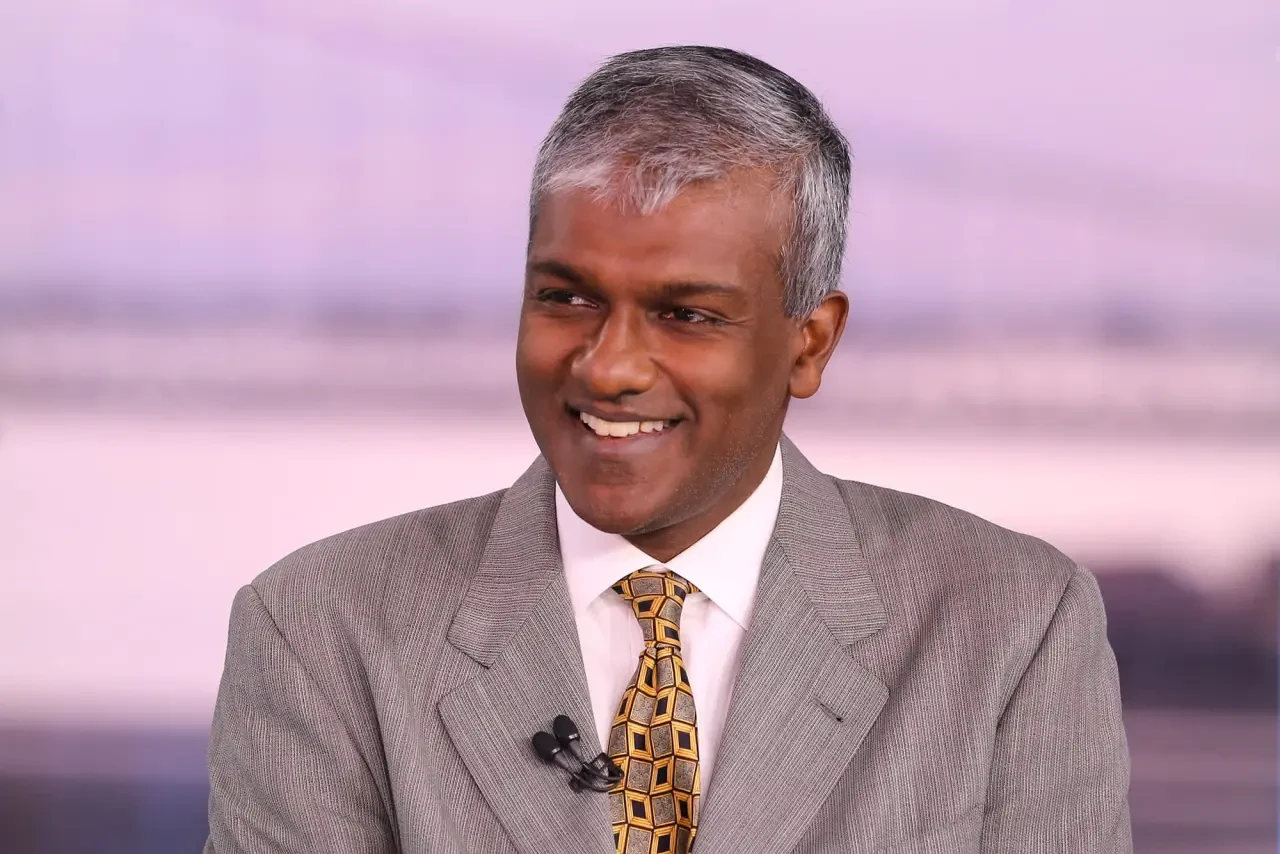

Renowned investor Dan Niles recently shared his strategy to invest in underperforming technology stocks, stating that he is considering buying names that he previously thought were overvalued. Niles, the founder of Niles Investment Management, mentioned on CNBC's "Money Movers" that certain tech stocks have reached attractive price levels due to market fears being discounted.

Notably, he highlighted Apple and Alphabet, pointing out that although Alphabet's shares were up over 2% in afternoon trading, Apple's shares had dipped by 0.3%. Year to date, Alphabet has faced a nearly 10% decline, while Apple has slipped over 5%, both trailing the broader market's performance.

With the recent implementation of tariffs by U.S. President Donald Trump, stocks experienced a sell-off during the session. Niles expressed confidence that the tariff issues with Mexico and Canada would be resolved, emphasizing the more challenging situations with the European Union and China.

Positive Performance of Apple and Alphabet

While Alphabet's shares saw an increase of more than 2% in afternoon trading, Apple's shares experienced a slight pullback of 0.3%. Year to date, Alphabet has declined by nearly 10%, and Apple has dropped by over 5%, both performing below the broader market.

In response to the market conditions, Niles indicated his interest in diversifying his investments beyond tech stocks to sectors like networking, mid-cap and value stocks, as well as domestic banks. He believes that companies involved in moving artificial intelligence data, rather than AI infrastructure spenders, will benefit in the current environment.

Market Trends and Tariffs Impact

During the same period, the S&P 500 has fallen by more than 1%. Niles expressed his belief that stocks are now discounted enough to warrant investment, especially in the names he has been monitoring. His comments come amidst a market selloff triggered by President Donald Trump's tariffs on Mexico, Canada, and China.

Looking ahead, Niles acknowledged the potential challenges in the market and stressed the importance of adaptability. He emphasized a focus on the fundamental picture while considering various investment opportunities in different sectors. As he evaluates the evolving market landscape, Niles aims to make strategic investment decisions that align with his outlook for the year ahead.

Looking Beyond Tech Stocks

Niles mentioned his interest in exploring sectors beyond tech, such as networking, mid-cap, and value stocks, along with domestic banks. He believes these sectors will benefit from the movement of artificial intelligence data and infrastructure spending. Despite anticipating a challenging year, Niles emphasized the importance of adaptability and focusing on the fundamental aspects of investment.

Dan Niles announced his intention on Tuesday to invest in technology stocks that have not met expectations in the market this year. The founder of Niles Investment Management stated that he sees an opportunity to buy stocks that he previously considered overvalued but are now at more attractive price levels due to market fears being discounted.