Garcia discussed the latest developments and trends in the stock market, providing valuable analysis for investors. She highlighted key factors impacting the performance of these companies and offered her perspective on their future prospects. Garcia's expertise and market knowledge added depth to the discussions, giving viewers valuable information to consider when making investment decisions. Her appearance on "Power Lunch" provided viewers with unique perspectives and valuable insights into the market dynamics surrounding Tesla, Moderna, and Ebay.

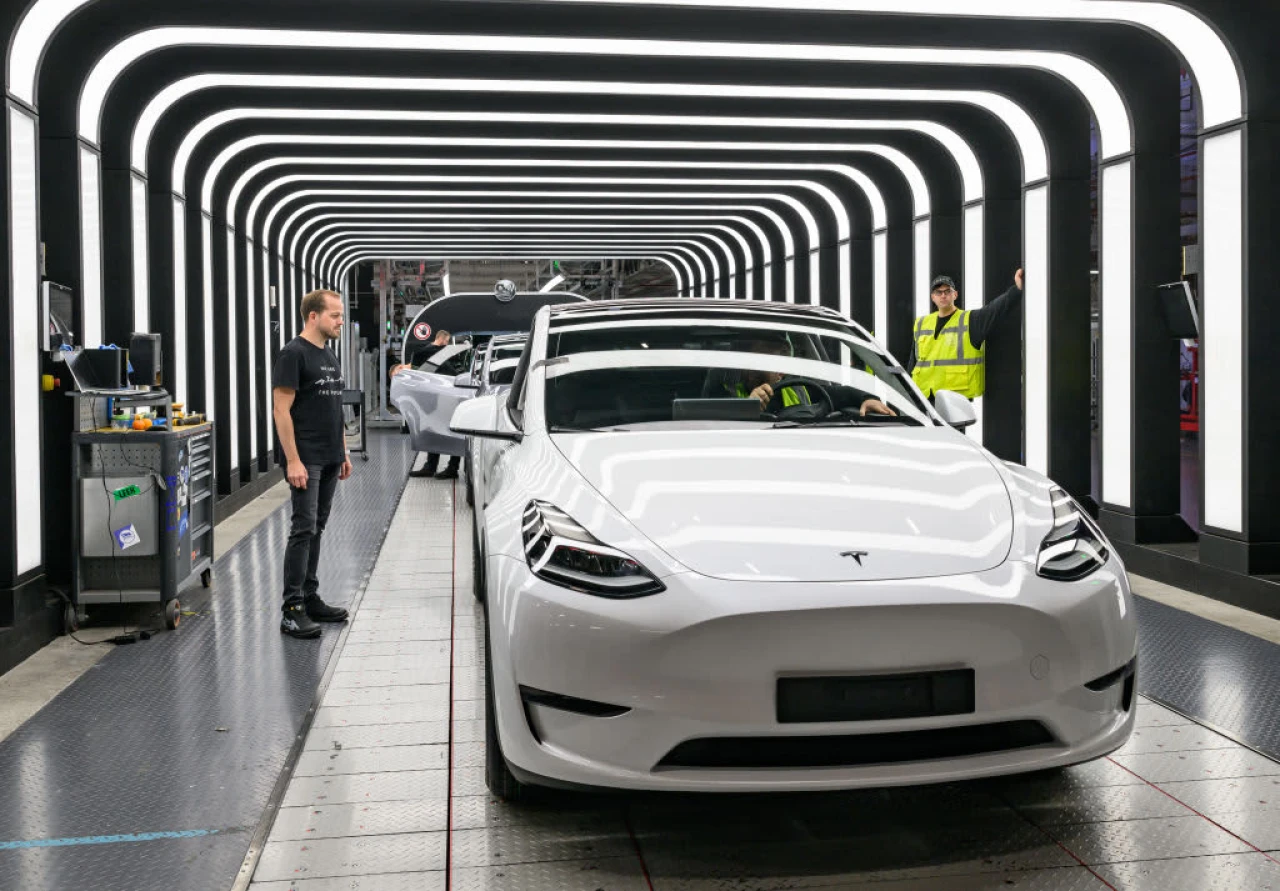

The year 2025 has not been kind to Tesla and Moderna stocks, and according to senior wealth advisor Courtney Garcia from Payne Capital Management, the tough times are far from over. During an appearance on CNBC's "Power Lunch," Garcia shared her insights on the market's major players.Starting with Tesla, Garcia advised staying on the sidelines due to the company's lofty valuation and the increasingly competitive auto market.

Despite hopes pinned on CEO Elon Musk's ties with former President Donald Trump and the upcoming release of a lower-priced electric vehicle, Garcia remains cautious. With Tesla heavily reliant on its auto business and facing challenges like slowing industry growth and pricing pressures in key markets like China, Garcia highlighted the stock's sky-high valuation as a major concern. She emphasized that Tesla's current price-to-earnings ratio of over 105, well above its historical average, makes it an expensive bet compared to the broader market.Meanwhile,

Tesla: High Valuation and Slowing Market

Courtney Garcia, a senior wealth advisor at Payne Capital Management, shared her insights on Tesla during CNBC's "Power Lunch." She expressed caution regarding Tesla's sky-high valuation and the challenges in the auto market. Despite expectations of benefits from Elon Musk's relationship with President Donald Trump and the upcoming lower-priced EV, Garcia believes that the current valuation of Tesla is a major concern.

With Tesla's core business in autos facing slowdowns and price competition in markets like China, Garcia advised against immediate investment due to the high valuation compared to historical averages.

Recent reports of re-evaluation of federal contracts have impacted Moderna's stock performance, leading to a 25% decline this year. Garcia recommended a cautious approach, urging investors to wait on the sidelines given the uncertainties surrounding the company's revenue sources.

Moderna: Concentration on Covid Vaccine

Garcia also discussed Moderna, highlighting the company's heavy reliance on its Covid vaccine for revenue. While acknowledging potential long-term opportunities in mRNA applications, she expressed reservations about the stock's concentration on Covid vaccines.

Moderna, the vaccine maker, also received a skeptical outlook from Garcia, who pointed out the company's heavy reliance on its Covid vaccine for revenue. Despite potential in Moderna's mRNA pipeline, Garcia advised caution, citing the stock's vulnerability to fluctuations in Covid-related demand. Recent reports of federal health officials re-evaluating a contract with Moderna for a bird-flu vaccine further added to the downward pressure on the stock, which has already seen a 25% decline in 2025 and a significant 68% drop over the past year.On a more positive note,, Garcia expressed bullish sentiment towards e-commerce platform eBay, even after a disappointing quarterly report led to an 8.2% decline in the stock.

Ebay: Innovation and Growth Potential

Contrary to her stance on Tesla and Moderna, Garcia sees e-commerce platform Ebay as a promising investment opportunity. Despite Wall Street's disappointment with Ebay's recent quarterly report and lowered revenue forecast, Garcia remains bullish on the company's future growth prospects.

She emphasized Ebay's efforts in innovation, highlighted by partnerships with Facebook Marketplace and OpenAI. Garcia believes that Ebay's success in collectibles and luxury goods, along with its commitment to innovation, positions the stock favorably for short-term gains despite temporary setbacks.

Despite the setback, Garcia sees long-term growth potential in eBay, highlighting the company's innovative strategies such as partnerships with Facebook Marketplace and OpenAI. With a track record of success in collectibles and luxury goods, Garcia believes eBay's growth prospects outweigh short-term concerns, including recent fee changes affecting UK sellers.In conclusion, Garcia's analysis paints a challenging picture for Tesla and Moderna stocks in 2025, while offering a more optimistic view on eBay's future growth opportunities despite recent market turbulence.